Checking Account

Unlock the benefits of hassle-free banking with Greater Texas Credit Union's Free Checking Account! Enjoy no monthly fees, no minimum balance requirements, and earn interest on your deposits. With convenient features like early direct deposit, free access to ATMs, and a premium debit card, managing your finances has never been easier. Plus, benefit from our community-focused approach, offering lower fees and better rates. Open your Free Checking Account today and experience superior service and financial freedom.

Greater Texas Credit Union Free Checking Account

- Early Direct Deposit: Get paid up to 2 days early.

- No Monthly Fees: Enjoy a $0 monthly fee

- No Minimum Balance: Keep your account with $0 minimum balance requirements

- Earn Dividends: Earn up to 0.05% APY* for balances $1,250 and over

- Low Opening Deposit: Start with just $25

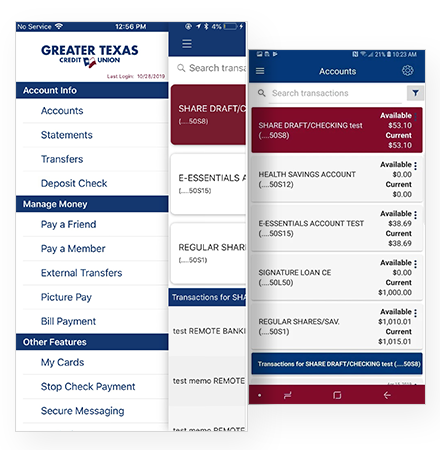

Convenient Digital Banking

Convenient Digital Banking

- View balances and activity

- Transfer funds

- Deposit checks remotely

- Locate a branch or ATM

Additional Perks

- Premium Debit Card

- Free Access to ATMs

- Unlimited Check Writing

- Overdraft Protection

★★★★★

“I have had bank accounts in small town banks to big box banks. I have to say I have been extremely pleased with the service and support this institution offers. It has by far the best rates on Auto/Home loans. It is a very easy process to apply online and get approved. Once I actually walked into the dealership and found out they were a participating lender, I never saw a bank officer and got to sign all documents online with my iPhone and left with my car the same day. This is the longest I have stayed with one bank (3 years) and I am never going anywhere else! Nothing to complain about here!”

- Current Member

- Current Member

What Members are Saying

Frequently Asked Questions

Can I open a Truly Free Checking Account online?

Yes, members can open a truly free checking account online. Non-members can establish their credit union membership online and open a truly free checking account at the same time. Learn how to open an account online.

Do I have to be a member to open this account? Does every authorized user have to be a member?

Yes, you need to be a member to open a checking account. All authorized users must qualify for membership, but do not need to previously be a member.

Becoming a credit union member is quick and easy. You can register by opening a savings account online or in a branch. What’s more, you can open a checking account at the same time. Authorized users added to the account will automatically become members.

How quickly can a new member open an account?

You can open a new credit union account online today!

Once you’ve identified the right credit union and gathered all the appropriate information (social security number/tax ID, physical address, and valid government ID), you can become a member by registering online or in a branch.

After that, opening an account with a small initial deposit is quick and convenient, and your $25 initial deposit is available for withdrawal the next business day!

Is this account good for students?

Yes, this account is great for students who are 18 years or older.

It requires no minimum balance, so students won’t be charged for a low balance in the account. We also offer added benefits for university students such as our Texas State SuperCat debit card, and five free ATM transactions per month on network ATMs.

Students can also enjoy overdraft protection, and opt-in to take advantage of our overdraft privilege program.

There are additional perks that make a Greater Texas Credit Union online checking account the ideal accessory for students with busy social and academic lives. For one thing, you can deposit checks and pay family and friends through our mobile app. You can also choose from a variety of designs for your card to make it uniquely yours.

Additionally, students enrolled at Texas A&M can earn entries into our annual Tuition Takedown Giveaway by making debit card purchases with the card associated with their free checking account.

Does it cost anything to open a regular checking account? Are there any annual fees?

To open a checking account, you must currently be a member of the credit union or establish your membership by opening a savings account. This can be done online or in a branch with a deposit of $5.

The checking account can be opened at the same time with an additional minimum opening deposit of $25. This amount will cover the cost of your first box of checks if you want to order them.

Once you have signed up, that’s it. There are no monthly or annual fees for either a checking or savings account.

What kind of savings accounts does a Great Texas Credit Union offer?

When it comes to savings accounts, we offer a variety of options.

Our Regular Savings Accounts allow members to build up savings over time. Money Market Accounts offer higher interest rates than the regular option, or you can save for retirement with our IRAs.

Members can also save for the holidays throughout the year with our Christmas Club Accounts, or pay for health expenses through our tax-advantaged Health Savings Accounts.

Why is a deposit needed to open the checking account?

The $25 initial deposit to open a checking account is to verify funds for the account. The deposit is required even if you don't want to order checks. It is available for access and withdrawal the next business day. A savings account only requires $5, which stays in the account throughout the lifetime of the account.

After that, there are no monthly fees, and no minimum required balance for your checking account.

Does there have to be a minimum amount in a checking or savings account at all times?

We do not require a minimum balance in the checking account. For savings, the minimum account balance is $5.

How long does it take to receive my debit card by mail after opening a checking account?

Once the checking account has been opened, and the debit card has been requested, it should take 3-5 business days to receive the debit card in the mail.

Is a credit check required to open a free checking account? What if I have bad credit?

No, a credit check is not required to open the account. Members can use this account regardless of their credit score or standing. However, a check will be run through ChexSystems to ensure there are no derogatory reports from previous financial institutions.

Can I get overdraft protection with a free checking account?

Yes. Members can opt into overdraft protection on their checking accounts. Funds will be transferred from the member’s savings account to cover checking charges.

What is my routing number?

The credit union's routing number is: 314977337.